This is a dark night of a wintry City of London - the banks' 'dark night of the soul' continues even in Summer months with Barclays profits (mainly from investment bank Bar Cap), almost 'normal' high profit by HSBC, and return-to-profit by LBG with margins also creeping up.

This is a dark night of a wintry City of London - the banks' 'dark night of the soul' continues even in Summer months with Barclays profits (mainly from investment bank Bar Cap), almost 'normal' high profit by HSBC, and return-to-profit by LBG with margins also creeping up. But, short and medium term uncertainties continue, especially for banks that are directly as well as indirectly in the power of government to influence. Government may decide to split investment banking from traditional banking? This has yet to be investigated and debated. Perhaps the big banks feel these are arguments they can win, and yet they appear to be risking government anger by not growing small firm lending, which after all is only 1.5% of their balance sheets! LBG, with the biggest market share in UK banking (c.25+%) appears to have it first priority to get its share price above the threshold of 62p, which it has achieved, and then past 73p when government might be tempted to sell so that it might escape state control, for reasons not unlike its change of mind half a year ago over participation in the Bank of England's APS.

For the government and the economy the biggest question repeatedly asked is why are banks not lending more to businesses to aid recovery, especially to SME firms? This is deeply vital to its economic forecasts.

The UK government's economic strategy depends on the Office for Budget Responsibility's forecast that job creation will repeat the experience post 1991 recession.

But are UK banks doing their bit to make this happen? Whether less bank lending results in serious damage to the economy depends upon what bank credit is financing. If financing intra-financial sector activity the impact on aggregate demand may be minimal. Asset prices fell 25% in the credit crunch and after sell-offs, some recovery and shift to fair value accounting are today 10% below pre-crisis peak, but in the property asset class which constitutes banks' biggest collateral exposure may still be 20% off, and that is without a compensating inflation as in past property collapses of the 70s, 80s and 90s causing unexpected complications.

But are UK banks doing their bit to make this happen? Whether less bank lending results in serious damage to the economy depends upon what bank credit is financing. If financing intra-financial sector activity the impact on aggregate demand may be minimal. Asset prices fell 25% in the credit crunch and after sell-offs, some recovery and shift to fair value accounting are today 10% below pre-crisis peak, but in the property asset class which constitutes banks' biggest collateral exposure may still be 20% off, and that is without a compensating inflation as in past property collapses of the 70s, 80s and 90s causing unexpected complications. If banks grow credit to finance stock-building, consumer spending or purchases of plant and machinery, or covers cash-flow gaps and running losses while businesses expand or cope with a downturn, then the real economic impact will be direct.

The banking system is is essential pump-priming in the economy. Depression is associated with a collapse of bank lending and money supply (on assets side not just liabilities side of banks' balance sheets).

Even non-monetarists should be watching money supply (disaggregated) and bank lending numbers like a hawk. If bank credit stagnates and or continues to contract, especially in areas where economic growth would be directly boosted, then the government and everyone else can conclude the economy is not being served by its banks.

Banks have few friends and admirers; few happy customers. They should be doing all they can to be genuinely seen to be helping economic recovery even if it means postponing restructuring their balance sheets to get back to 'normal' 150-200bp/assets margin profits sooner than later. Are the banks looking back to the last recession recovery period that of the 1990s and seeking to replay their lending recovery of those years? I suspect they may be doing this but drawing negative conclusions.

The property market in low inflation is not liquid and not providing the lending demand that would boost economic recovery as it did in the 1990s. Banks must therefore this time look more positively at business lending. Part of the government's strategy and forecast is to grow UK trade, not least manufacturing on which the UK still relies for over 40% of its exports but has low bank borrowing and low debt servicing (10% of profits); most of UK industry is under-borrowed.

The property market in low inflation is not liquid and not providing the lending demand that would boost economic recovery as it did in the 1990s. Banks must therefore this time look more positively at business lending. Part of the government's strategy and forecast is to grow UK trade, not least manufacturing on which the UK still relies for over 40% of its exports but has low bank borrowing and low debt servicing (10% of profits); most of UK industry is under-borrowed.The banks claim they approve 80% of loan applications, by which they really mean 80% of those judged to be higher quality borrowers, which, as BBA spokesperson says, "have good business models" (pots and kettles?) as if banks really knew, but that translates to about 40% of loan demand being satisfied and many of these are merely loan roll-overs, not net increases because loan outstandings are not growing.

Banks also all say that businesses are more interested in building savings and lowering their debt. That may have been more true over a year ago, but corporations are raising bond finance and equity while SME firms wholly depend on banks. But this is a function of small firms birth and death rates. Annually a third of a million firms close for various reasons of which under 10% go bust, and a third of a million start up. In recession and low growth periods start-ups fall more than closures rise. The sad fact is that banks are building up the share of deposits in their liabilities and to do so holding down loan approvals (stricter credit risk conditions like higher collateral, even insisting on more liquid collateral!) and thereby shrinking their total loans in real if not absolute terms.

UK banks lending from UK branches is making zero additional lending in aggregate. Better (positive) lending is available from foreign banks into the UK, but that hardly qualifies as banks playing their part in recovery.

UK banks lending from UK branches is making zero additional lending in aggregate. Better (positive) lending is available from foreign banks into the UK, but that hardly qualifies as banks playing their part in recovery.  HSBC's mid-year results may have lifted banks shares by up to 5%, but the components of revenue growth invite questions and there are several overhanging questions that are troubling to the banks:

HSBC's mid-year results may have lifted banks shares by up to 5%, but the components of revenue growth invite questions and there are several overhanging questions that are troubling to the banks:- can government persuade the banks to increase small firm lending? - balance sheet shrinkage - when is it time to stop and to grow new business? - how to cut costs without losing good people and harming valuable business? - will UK Banking Commission recommend splitting off investment from 'trad' banking? - it reports by Sept.'11; can or will government sell any bank shares before then? - from profit what splits to make between Retained profit / Dividends / Bonuses? - is net interest income solid so that dividends & shares can dependably rise? - will corporate bonds and small firm defaults peak later or are we over the hump? - additional regulations to curb risk-taking: are they a real burden; do they work? - sales of banking & other units; are the issues more problematic than their price? - what is the value of branch networks to retail commercial banking? - can banks solve their core systems problems to update and replace them soon? - living wills, how to simplify large banking groups to satisfy the regulators? - are our largest banks beyond management oversight & control by boards? - if so, how and with what systems to assert effective control of 'risk appetite'? - are supervisory regulators going to 'pass' all the banks risk reporting? - where are UK, USA, EU economies & global trade heading - new patterns to finance? - can banks do comprehensive macro-modelling required by Basel II Pillar II? - property holdings of banks from foreclosures - is it now time to sell? - is confidence restored among funding sources to easily finance funding gaps? - back-to-normal? Can banking return to doing business just as before the crisis?

Answering such questions is the work of very special consultant experts, who may borrow watches to tell the time and check the wall clocks, but the landscape of time telling for banks has become exceptionally surreal, very Daliesque. Nearly all bankers they are in strange territory doing business in circumstances they have no previous experience of.

I (and my colleagues at Asymptotix.eu and elsewhere) have ready answers for all of the above and more. I (we) daily get calls from strategy advisers, institutional investors, banks, and sometimes regulators, to discuss such questions at £200 per hour, sometimes, irritatingly, they get advice for 'free'! I (we) often feel like private sector solicitors practising in regulatory law or like proof-of-concept supervisory regulators.

I (and my colleagues at Asymptotix.eu and elsewhere) have ready answers for all of the above and more. I (we) daily get calls from strategy advisers, institutional investors, banks, and sometimes regulators, to discuss such questions at £200 per hour, sometimes, irritatingly, they get advice for 'free'! I (we) often feel like private sector solicitors practising in regulatory law or like proof-of-concept supervisory regulators.In the past two decades, traders and junior managers increasingly drove banking businesses silo-fashion. Banks looked more like conglomerations of specialist units - mortgages - business lending - trading teams per asset class - structured products - domestic - international - retail - investment - all divining their own risk appetite (that ubiquitous term beloved of risk regulation and private client investing that no-one really knows how to define or compute) and they were silo-wise responsible for their own narrowly defined profit/loss.

Like clock mechanism in which each of the cogs are acting quasi-independently at whatever speeds they can the whole rarely tells the right time (in terms of the underlying economies) and were out of control, but who cared so long as bookable profits resulted, whether realised or not. In a much more fragile environment boards have struggled to reassert control and are discovering just how difficult, even impossible, that is! They, boards and regulators and central banks, would love to be able to understand banks and see them working like clockwork, like a mechanism with a handle that they can jointly operate -

Like clock mechanism in which each of the cogs are acting quasi-independently at whatever speeds they can the whole rarely tells the right time (in terms of the underlying economies) and were out of control, but who cared so long as bookable profits resulted, whether realised or not. In a much more fragile environment boards have struggled to reassert control and are discovering just how difficult, even impossible, that is! They, boards and regulators and central banks, would love to be able to understand banks and see them working like clockwork, like a mechanism with a handle that they can jointly operate -  - but it's not like that! Banks position and reposition themselves to service whatever business demand comes to them. They also like to believe they find that business with professional skill, creatively and diligently. But, when they really have to compose how and what they do in uncertain times self-confidence goes and the banks look like mechanisms that have lost battery power and need governments to shake or turn the winding spring. To feel like passive victims of events, no longer 'masters of the universe' is galling and anxiety-making - they now know that they cannot really justify their bonuses but cannot bear to countenance that!? Many bankers know they do not know banking like a watchmaker knows his mechanisms; they do not see the whole of the back mechanism. This is the culture change that Basel II regulations insisted upon, that bankers should comprehensively know their banks and understand how risks are interconnected and how their business performance relates to risk-taking, to 'risk appetitie'.

- but it's not like that! Banks position and reposition themselves to service whatever business demand comes to them. They also like to believe they find that business with professional skill, creatively and diligently. But, when they really have to compose how and what they do in uncertain times self-confidence goes and the banks look like mechanisms that have lost battery power and need governments to shake or turn the winding spring. To feel like passive victims of events, no longer 'masters of the universe' is galling and anxiety-making - they now know that they cannot really justify their bonuses but cannot bear to countenance that!? Many bankers know they do not know banking like a watchmaker knows his mechanisms; they do not see the whole of the back mechanism. This is the culture change that Basel II regulations insisted upon, that bankers should comprehensively know their banks and understand how risks are interconnected and how their business performance relates to risk-taking, to 'risk appetitie'. The same questions as banks are asking of themselves, those whose pay-grade and seniority warrants looking at the big picture, which is precious few people in any bank, are also being asked by wholesale funders, institutions and other banks. The gauge is funding gap financing. Which banks can fund themselves more easily and cheaper than others? Share investors are wanting to get back into bank shares but which banks' performance to trust. These questions I get asked regularly, but it is hard work to explain to others the composition of factors in the different shaped mechanisms of different banks. Banks are far less uniform internally than they appear to be outwardly. My answers begin with the risk diversity of each bank depending upon the national economies where they do business, are these export-led i.e. business lending and capital investment biased, credit-boom i.e. property and household lending biased, a mix of these in cross-border terms or in terms of some countries compared to others. Then what are the internal culture, management and systems qualities of each bank - how well-driven from the board-room or how lucky or unlucky are they. Do their mechanisms work well in a coordinated way or not? Have they he ability to model and track their business in its various contexts? Do they know their aggregated and disaggregated risk appetite and risk diversity?

The same questions as banks are asking of themselves, those whose pay-grade and seniority warrants looking at the big picture, which is precious few people in any bank, are also being asked by wholesale funders, institutions and other banks. The gauge is funding gap financing. Which banks can fund themselves more easily and cheaper than others? Share investors are wanting to get back into bank shares but which banks' performance to trust. These questions I get asked regularly, but it is hard work to explain to others the composition of factors in the different shaped mechanisms of different banks. Banks are far less uniform internally than they appear to be outwardly. My answers begin with the risk diversity of each bank depending upon the national economies where they do business, are these export-led i.e. business lending and capital investment biased, credit-boom i.e. property and household lending biased, a mix of these in cross-border terms or in terms of some countries compared to others. Then what are the internal culture, management and systems qualities of each bank - how well-driven from the board-room or how lucky or unlucky are they. Do their mechanisms work well in a coordinated way or not? Have they he ability to model and track their business in its various contexts? Do they know their aggregated and disaggregated risk appetite and risk diversity? These are the essential questions that supervisory regulators ask in risk audits (to the best of their abilities in judging the data they are presented with). But, the fact is that all major banks and most others have severe problems of one sort or another, and then the question is do these problems matter short, medium or long term?

The systemic context is important but that is subsumed within macroeconomic forecasting, and here lies the rub. The performance of economies are very dependant on what banks collectively do, but the banks don't want to see matters that way; they prefer the idea of having no direct responsibility for the behaviour of economies! Banks cannot (refuse to) factor themselves into the confidence and riskiness of clients and customers.

The systemic context is important but that is subsumed within macroeconomic forecasting, and here lies the rub. The performance of economies are very dependant on what banks collectively do, but the banks don't want to see matters that way; they prefer the idea of having no direct responsibility for the behaviour of economies! Banks cannot (refuse to) factor themselves into the confidence and riskiness of clients and customers.When the Credit Crunch struck UK banks had nearly £1 trillion in funding gap (between deposits and loans). That was double their regulatory 'own capital' and 15% ratio to total assets (loans & net trading investments). In general funding gaps are borrowing short to lend long, precisely the liquidity risk in the liabilities side of their balance sheets that is generally derided as classic high risk. In the years 2000/1-2007/8 funding gaps grew almost exponentially. Had recession kicked in two years earlier in 2006 problems of the Credit crunch would have been much less severe. Structured products (securitizing loanbooks) postponed recession by two years. Those banks with the largest funding gap refinancing needs in 2008 were hit worst by the short-sellers when they refused to jump at the hurdles of sharp rises in funding gap price spreads for fear of losing their bonus-laden profits. The results were they risked their banks' solvency.

If banks should operate in repeating fashion year-round like clocks, bankers do so like thoroughbred horses in a steeplechase taking bets, but running the course too -

- where the fences are like funding gap financing, turning over medium term notes and covered bonds and seeing loans recycling back onto balance sheets as deposits. In the Credit Crunch that refinancing got harder, the fences higher, and many horses fell.

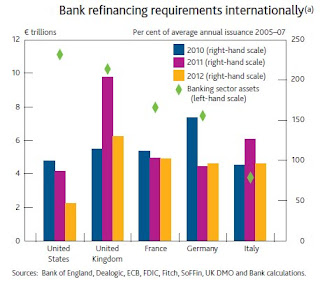

- where the fences are like funding gap financing, turning over medium term notes and covered bonds and seeing loans recycling back onto balance sheets as deposits. In the Credit Crunch that refinancing got harder, the fences higher, and many horses fell.  The UK banks' financing fences remain high today. While banks of other major European countries, such as France, Germany and Italy, face major funding issues mainly next year, none have to refinance the same amount as UK banks, which must replace debt securities of twice as much as the average in 2005-07.

The UK banks' financing fences remain high today. While banks of other major European countries, such as France, Germany and Italy, face major funding issues mainly next year, none have to refinance the same amount as UK banks, which must replace debt securities of twice as much as the average in 2005-07. But, with government's help (Bank of England asset swaps worth £500bn) and their own balance sheet shrinkage (first netting off derivatives, then liquidating other own portfolio trading assets, withdrawing cross-border interbank lending, and letting loans mature with minimal new lending (i.e. shrinking their loan books) and waiting for deposits to rise, UK banks' funding gaps have shrunk from nearly £1tn to less than half of that!

LBG and RBS restructured their balance sheets most of all - they had to - including reducing assets (loans & trading book) by more than a third over the short to medium term, 1-3, not 1-5, years. This was largely to better manage their refinancing requirements, reducing wholesale funding and the % of short-term financing within that. The Bank of England (and no doubt UKFI ltd. of HMT) advised all banks to shift their wholesale borrowing to longer term maturities (as the government itself was also doing) and of course thereby getting that borrowing more in line with asset maturities - and worry less about interest rate risk. The banks have to forecast and calculate the 'stickiness' of deposits, more closely align liabilities (mainly deposits) to assets (mainly loans) - in effect get the cogs of the banks on both sides of their balance sheets to move more precisely with each other.

This restructuring forces banks to stop net new lending - but why? The answer is, like government borrowing and budget cuts, the fear is of negative judgement by credit markets, the markets who by recoiling in sudden panic propelled the credit crunch. The banks collectively have to cope with:

This restructuring forces banks to stop net new lending - but why? The answer is, like government borrowing and budget cuts, the fear is of negative judgement by credit markets, the markets who by recoiling in sudden panic propelled the credit crunch. The banks collectively have to cope with:- cross-border interbank lending rapid shrinkage

- closing funding gaps substantially i.e. shrinking customer lending by 20-30%

- let 3% annual inflation whittle away at private sector debts

- play for time for mortgages to amortise so outstandings and LtV ratios fall

- build up capital and prepare for off-balance sheet assets coming back on

- work out delinquent loans and not make new ones for fear of higher defaults

- prepare for possibility that past pattern of trade and bank lending cannot be repeated again, not in next 5 years or so at least?

Internally within individual banks, shrinking balance sheets to realign assets and liabilities appears sensible and prudent, but not when all banks in aggregate are doing the same! Externally, to those on whom banks should be seeking to win back goodwill and confidence, it looks like selfishly putting the banks first and the economy second. If we want our banks to look more like traditional clockwork mechanics, then the rest of the economy will have to shrink too and grow more closely to the lower rate of income growth with much less credit recycling.

Government won't mind that so long as there is at least positive growth in the economy above the rate of inflation and a prospect of tax revenue recovery without higher tax rates. But, its projections depend on employment growth and unemployment falling, on higher exports, lower imports, on banks and other services continuing to generate net foreign earnings to offset the trade deficit, and on the balance of payments not worsening over-much even if the trade deficit balance narrows i.e. a conjuncture of positive factors - but it is many years since we have done anything like that while bank lending has ceased to grow or shrink! In past recessions and recovery periods bank lending did not absolutely shrink! This time is perilously new.

Government won't mind that so long as there is at least positive growth in the economy above the rate of inflation and a prospect of tax revenue recovery without higher tax rates. But, its projections depend on employment growth and unemployment falling, on higher exports, lower imports, on banks and other services continuing to generate net foreign earnings to offset the trade deficit, and on the balance of payments not worsening over-much even if the trade deficit balance narrows i.e. a conjuncture of positive factors - but it is many years since we have done anything like that while bank lending has ceased to grow or shrink! In past recessions and recovery periods bank lending did not absolutely shrink! This time is perilously new.Without the high budget deficits of 10%+ of GDP, M2+ could have been contracting at more than 10%. Similarly, without the deficit nominal private sector output could have contracted at a depression rate that in the 1930s for several years was about 15% annually. Government has limits (partly those of Maastricht) to its fiscal stance so that it cannot on its own stop both real and nominal GDP stagnating, and in a world were most countries are seeking more external than internal growth impulse, the prospect of growing at substantial rates is low without substantial growth from capital investment for which bank lending to businesses is a major supply-side driver. The implication from ongoing contraction of bank lending and repair of bank balance sheets is that high government deficits to boost private sector output will continue just to keep nominal GDP from again contracting. Government attempts to recover the economy are made fragile by banks shrinking their loanbooks. For a private, highly leveraged, debt-based economy, there can be little or no private sector growth with bank lending contracting at 5-8% of private GDP.

UK banks need to refinance £390bn in the next two years, about £200bn in maturing bonds and residential-backed mortgage securities, remaining £190bn in reversing the asset repos (out of SLS & APS which the Bank of England insists will be phased out by the end of 2012) and existing preferred bank shares (£60bn) of Government bank capital funding, and the Credit Guarantee Scheme etc. Much of this is to do with how rapidly and how recently banks, biggest banks especially, grew their balance sheets just before the Credit Crunch hit.

UK banks need to refinance £390bn in the next two years, about £200bn in maturing bonds and residential-backed mortgage securities, remaining £190bn in reversing the asset repos (out of SLS & APS which the Bank of England insists will be phased out by the end of 2012) and existing preferred bank shares (£60bn) of Government bank capital funding, and the Credit Guarantee Scheme etc. Much of this is to do with how rapidly and how recently banks, biggest banks especially, grew their balance sheets just before the Credit Crunch hit. Shrinking of balance sheets, and if combined with government retrenchment is undoubtedly a macroeconomic risk that could be worsened if government and regulators try to try to wean banks off Government support too quickly, even if, as some may think, it seems important to government budget balancing and spending cuts for the banks to become fully-privately funded as soon as practical? In my calculated view there is substantial profitable gain that will accrue to taxpayers from government retaining government support for banks longer than first planned. The mechanisms whereby this can happen are not clockwork - many confidence factors play a part including the relative perception of the UK versus other countries.

Shrinking of balance sheets, and if combined with government retrenchment is undoubtedly a macroeconomic risk that could be worsened if government and regulators try to try to wean banks off Government support too quickly, even if, as some may think, it seems important to government budget balancing and spending cuts for the banks to become fully-privately funded as soon as practical? In my calculated view there is substantial profitable gain that will accrue to taxpayers from government retaining government support for banks longer than first planned. The mechanisms whereby this can happen are not clockwork - many confidence factors play a part including the relative perception of the UK versus other countries.  The Bank of England admitted in its Financial Stability Review that replacing funding gap finance as it falls due is a "substantial challenge", and put the total figure on the amount that UK banks need to refinance by the end of 2012 at £750bn to £800bn (half of which I judge therefore to be reverse asset repos of what is pledged at the Bank of England and maybe, conceivably another £150bn elsewhere, plus about £300bn maturing securities paper like Medium Term Notes), working out an average monthly fundraising of more than £25bn. This looks like a precise 12 hour 25bn per hour clock - actually it is not like that, more lumpy, with an average of 2-3 months to get large MTNs away 9fully subscribed). Some banks have rolling MTN programmes in different currencies (£,$,€) of 5, 10 and 20-50bn each. Maybe they could roll up more of their loan books into SPVs with clearly attractive rates and standby liquidity financing with Bank of England support that might also gradually re-absorb some of the assets swapped there sufficient to attract institutional and foreign asset managers - rather than an on-off private or public liquidity funding support, more like the USA's TARF, a mix of both private and public structuring - just a matter of a well-geared beautifully-crafted central bank designed mechanism?

The Bank of England admitted in its Financial Stability Review that replacing funding gap finance as it falls due is a "substantial challenge", and put the total figure on the amount that UK banks need to refinance by the end of 2012 at £750bn to £800bn (half of which I judge therefore to be reverse asset repos of what is pledged at the Bank of England and maybe, conceivably another £150bn elsewhere, plus about £300bn maturing securities paper like Medium Term Notes), working out an average monthly fundraising of more than £25bn. This looks like a precise 12 hour 25bn per hour clock - actually it is not like that, more lumpy, with an average of 2-3 months to get large MTNs away 9fully subscribed). Some banks have rolling MTN programmes in different currencies (£,$,€) of 5, 10 and 20-50bn each. Maybe they could roll up more of their loan books into SPVs with clearly attractive rates and standby liquidity financing with Bank of England support that might also gradually re-absorb some of the assets swapped there sufficient to attract institutional and foreign asset managers - rather than an on-off private or public liquidity funding support, more like the USA's TARF, a mix of both private and public structuring - just a matter of a well-geared beautifully-crafted central bank designed mechanism? The assets swapped at the BoE belong to management holding companies ('Special Purpose Vehicles') and therefore quite how and how much will have to come back on balance sheet and at what cost is unclear? The Bank of England has the option to roll over the assets swaps for a longer period and could step in to expand the APS or create a new one or to use its balance sheet leverage to buy banks' securities, or create its own TARF, any of which I judge to be a profitable business and a good one for taxpayers to be in.

The assets swapped at the BoE belong to management holding companies ('Special Purpose Vehicles') and therefore quite how and how much will have to come back on balance sheet and at what cost is unclear? The Bank of England has the option to roll over the assets swaps for a longer period and could step in to expand the APS or create a new one or to use its balance sheet leverage to buy banks' securities, or create its own TARF, any of which I judge to be a profitable business and a good one for taxpayers to be in.If the banks had assurances from the Bank of England about how it can step in as a backstop to ensure completion of refinancing deals, then this might also usefully take the pressure off the brake on bank lending. Our clocks are currently going backwards!

If there is no such set of options and possibilities discussed with the banks, then anxieties remain that the banks' funds raising rate is dangerously high and hence they are currently back-pedalling fast to reduce it. A Bank of England prepared to extend liquidity at this time in a volume equivalent to its £200bn Quantitative Easing would reassure funding sources considerably. But, anyway, the banks have also boosted their liquidity reserves by a similar amount, but only part of these are clear funds that could only temporarily replace shortfall in funding gap financing.

If there is no such set of options and possibilities discussed with the banks, then anxieties remain that the banks' funds raising rate is dangerously high and hence they are currently back-pedalling fast to reduce it. A Bank of England prepared to extend liquidity at this time in a volume equivalent to its £200bn Quantitative Easing would reassure funding sources considerably. But, anyway, the banks have also boosted their liquidity reserves by a similar amount, but only part of these are clear funds that could only temporarily replace shortfall in funding gap financing.Raising money for and by banks may come up against a much tougher backdrop for the banking industry, especially once (and if at al) the EU stabilisation Fund of €750bn starts monetizing its state guarantees to borrow against its bonds (though I judge this will take most of this year to structure contractually) which though conditions (risk spreads) have improved marginally are still far from the easy money of the credit boom years.

No comments:

Post a Comment